Benefits of a Pooled Special Needs Trust

By Joanne Marcus, MSW, President and CEO of Commonwealth Community Trust (CCT)

A pooled special needs trust (PSNT) is administered by a non-profit organization that manages and invests funds for individuals with special needs. Distributions are made from the trust to purchase goods and services that supplement public benefits and enhance the beneficiary’s quality of life. All beneficiaries must have a disability, but not all beneficiaries receive public benefits. In some instances, a PSNT is a good option for beneficiaries who simply can’t manage their own financial affairs. Funds placed in a PSNT aren’t countable resources and don’t affect eligibility for means-tested government benefits such as Supplemental Security Income (SSI) and Medicaid. Failure to consider a client’s means-tested benefits can result in a malpractice claim, a breach of fiduciary duty or a dereliction of duty.

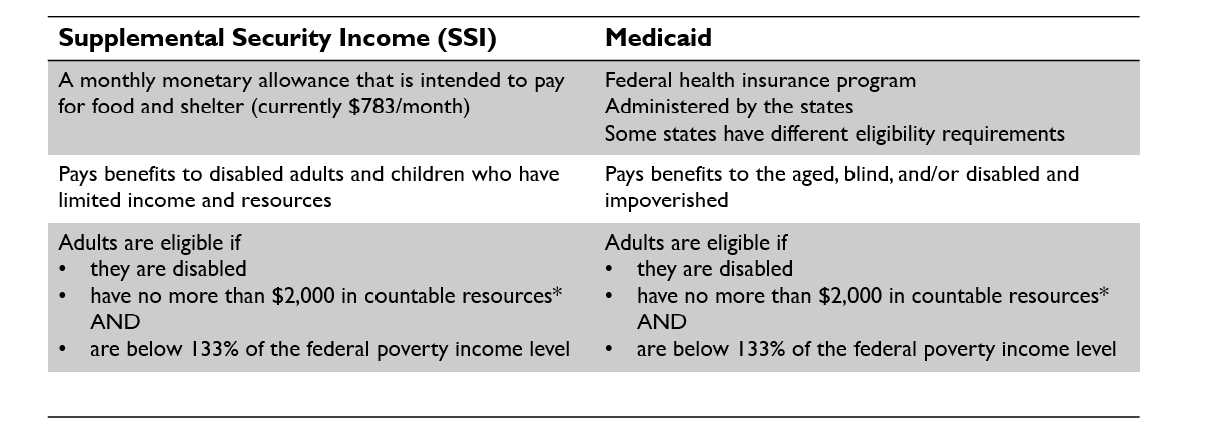

The following chart provides key information about Medicaid and SSI:

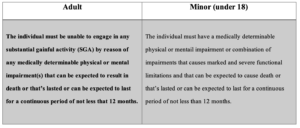

Clients may receive SSI, Medicaid, Medicare, Social Security Disability Insurance or a combination of benefits. The important consideration is that the individual has a disability. The following chart describing SSA’s definition of disability can be used as a guide:

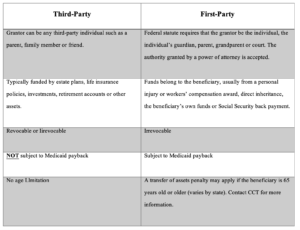

Two Types

There are two types of PSNTs:

To determine if a third-party PSNT is the right option for a client, ask these questions. If the answers are yes, then it’s the right option:

- Does the beneficiary receive means-tested benefits such as SSI and/or Medicaid?

- Will an inheritance left directly to the beneficiary jeopordize their benefit eligibility?

- Does your client wish to ensure financial support for the beneficiary when the client is no longer able to provide for the beneficiary?

- Is the beneficiary easily taken advantage of or not able to manage their own finances?

How Pooled Funds are Managed and Invested

Trust funds are pooled together for investment purposes, offering lower administrative fees and the potential for greater growth opportunity. Individual sub-accounts are maintained for each beneficiary, and all earnings based on a beneficiary’s share of the principal are reinvested into each sub-account. The beneficiary, or the beneficiary’s advocate, should have access to account information online or via financial statements sent on a regular schedule.

PSNTs serve beneficiaries of varying account sizes from modest settlements to those of more substantial amounts. Funding can be a lump-sum or part of a structured settlement. It isn’t unusual for a bank or other financial institution to require a minimum of $350,000 to $500,000 to fund a trust. A non-profit organization, on the other hand, may only require a minimum of $5,000 to fund a PSNT.

Setting Up a PSNT

Each grantor joins the pooled trust and agrees to the terms of the Master Trust Agreement by completing a Joinder Agreement, the legal document to join the PSNT. The Master Trust Agreement allows the non-profit organization to administer the pooled trust and sets out the terms of that administration.

How the Trust Can Be Used

To serve clients properly, trust administrators have the expertise to make disbursement decisions and understand the rules set forth by the Social Security Administration and Medicaid offices in each state. Disbursements from the trust are for the sole benefit of the beneficiary and have to be carefully reviewed to ensure protection of these benefits.

The allowable uses for PSNT include:

- Medication and devices

- Medical services

- Assistive technology

- Education

- Vehicle

- Housing

- Home modifications

- Home repairs and upkeep

- Case manager

- Caregiver services

- Clothing

- Household bills

- Vacations and travel

- Pre-need burial and funeral expenses

- Remainder Policy

Funds remaining in the account, on the death of a beneficiary who received Medicaid, are subject to repayment to the state(s) for medical bills paid during the beneficiary’s lifetime. Federal law allows the non-profit organization to retain the remainder for its charitable purposes in lieu of this repayment, but not all do. Some only retain in the instance that successor beneficiaries wouldn’t receive any of the remainder, and some retain all. Because the policies of individual PSNTs differ, it’s helpful to check with each one to understand its remainder policy completely.

Cost-Effective Framework

Setting up a PSNT can alleviate stress by providing individuals with a cost-effective framework for money management. Decisions should reflect concerns and hopes for the future as well as thoughtful planning for the resources that will be available to address a client’s needs. With its many benefits, clients will appreciate learning about the option to set up a PSNT.