Investment Information

CCT’s Board of Directors selected True Link Financial to manage and invest the trust funds. True Link was selected because of their expertise and commitment to working with pooled trusts nationally.

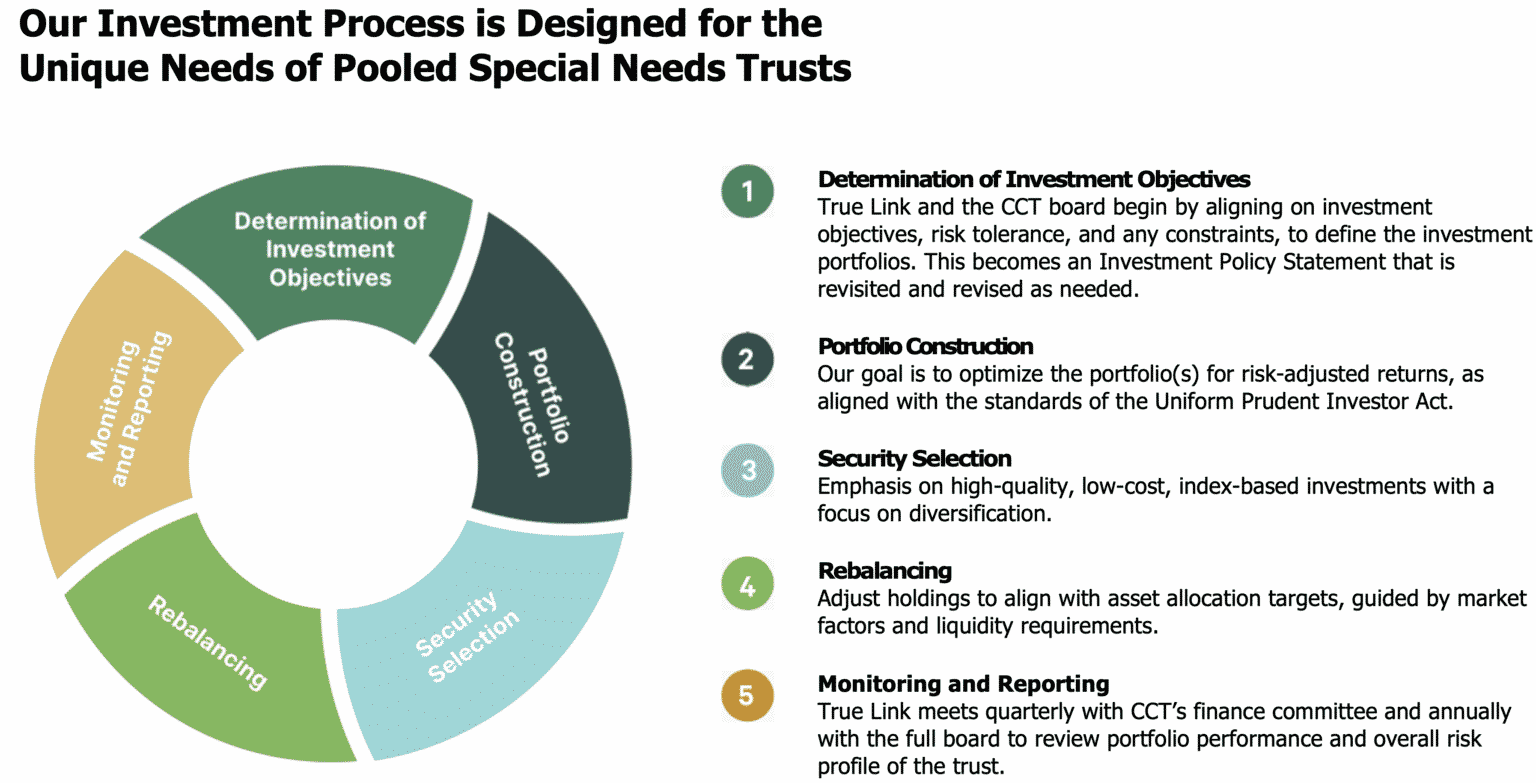

The Board of Directors approves the Investment Policy Statement (IPS) implemented by True Link Financial Advisors and meets quarterly with the True Link Financial Advisors Investment Team to review investment performance. Each year, True Link presents the investment performance to CCT's full Board of Directors.

CCT is not a chartered bank or trust company, or depository institution. It is not authorized to accept deposits or trust accounts and is not licensed or regulated by any state or federal banking authority

Management & Investment of

Trust Assets

The funds of the pooled trusts are invested and managed by True Link Financial Advisors, LLC* (True Link).

Each beneficiary has a sub-account which reflects the individual account activity. Cash from all sub-accounts are grouped, or “pooled” together, and invested. The goal of pooling of funds is to reduce the impact of administrative fees and to create the opportunity to invest in a broader range of investment options for the pooled trust. Appreciation and depreciation of invested assets, along with earned income are applied to each sub-account based on the beneficiary’s portion of the total pooled assets. CCT allows only cash deposits into the trust (via check, ACH, or wire); real estate or other non-cash assets are not accepted.

Financial records are maintained for each sub-account that reflect activity in the sub-account, such as sub-account balances, disbursements, and deposits.

The Beneficiary’s advocate named in the Joinder Agreement can access account information online through the Client Account Portal. For additional information about how to read a statement, click here: “How to Read Your Trust Statement.”

Pictured: Joanne Marcus, CCT’s President/CEO, Kai Stinchcombe, Co-founder and CEO, and Bryan Kreitzburg, Portfolio Manager at True Link Financial

Investment Policy Statement

The Investment Policy Statement (IPS) is carefully crafted and reviewed regularly by the CCT Board of Director’s Finance and Investment Committee. The Committee meets quarterly, or more frequently when needed, with representatives from True Link and Capital First to monitor and review performance of the portfolios. Annually, True Link provides a full report to CCT’s Board of Directors.

True Link

True Link Financial Advisors, LLC[1] serves as the investment manager for the Trusts. Oversight of True Link Financial Advisors is provided by the CCT Board of Directors.

True Link Financial, Inc. provides the trust administration software and record-keeping platform to the Trusts as well as the True Link Visa Prepaid Cards which help manage spending for beneficiaries. The record-keeping platform enables beneficiaries to request disbursements and aids in the provision of their quarterly sub-account statements.

CCT’s Multiple Portfolio Investment Model

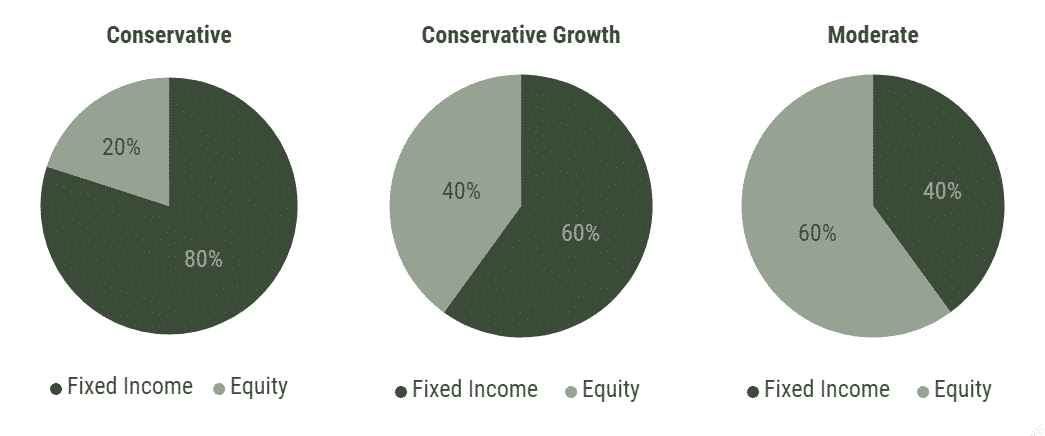

CCT trust assets are invested in one of three portfolios: Conservative, Conservative Growth, and Moderate. Sub-accounts with balances less than $3,000 are held in cash.

Capital First Trust Company (Capital First), trustee for CCT, determines the appropriate portfolio to align with an individual beneficiary’s investment profile.

New accounts are initially assigned to the Conservative Growth portfolio. Accounts are then assessed on an annual basis based on the criteria above (determined by the anniversary date of joining CCT) and then assigned to one of the three portfolios by the Trustee based on the assessment.

Management &

Investment of Trust Assets

As of July 1, 2024, CCT administers over $148 million in pooled trust accounts. This graph shows the value under management** from 2014 to July 1, 2024.

**The change in the value of the funds administered by CCT is attributable to factors such as deposit of additional funds, distributions, change in value of the investments, and investment income earned. This graph is not a depiction of investment performance.

The amounts do not include unfunded Third-Party Pooled Special Needs Trusts. Additionally, many existing trusts continue to be funded over the beneficiary’s life through structured settlements, lifetime contributions, etc.

CCT's most recent Form 990 disclosures are available on the IRS website. https://apps.irs.gov/app/eos/