Pooled Special Needs Trusts

Written By Rachel Baer, Esq., Counsel and Director of New Client Services at Commonwealth Community Trust

Special needs trusts are incredible tools to protect assets and means-tested benefits for people with a disability. There are two types of special needs trusts (SNT)—standalone special needs trusts and pooled special needs trusts. While many attorneys focus on standalone trusts, pooled trusts are more accessible to many clients due to the lower setup costs and the availability of professional administration with low starting balance requirements and reasonable ongoing fees. Whether the trust is large or small, pooled trusts should be presented as an option for clients to consider when choosing a special needs trust.

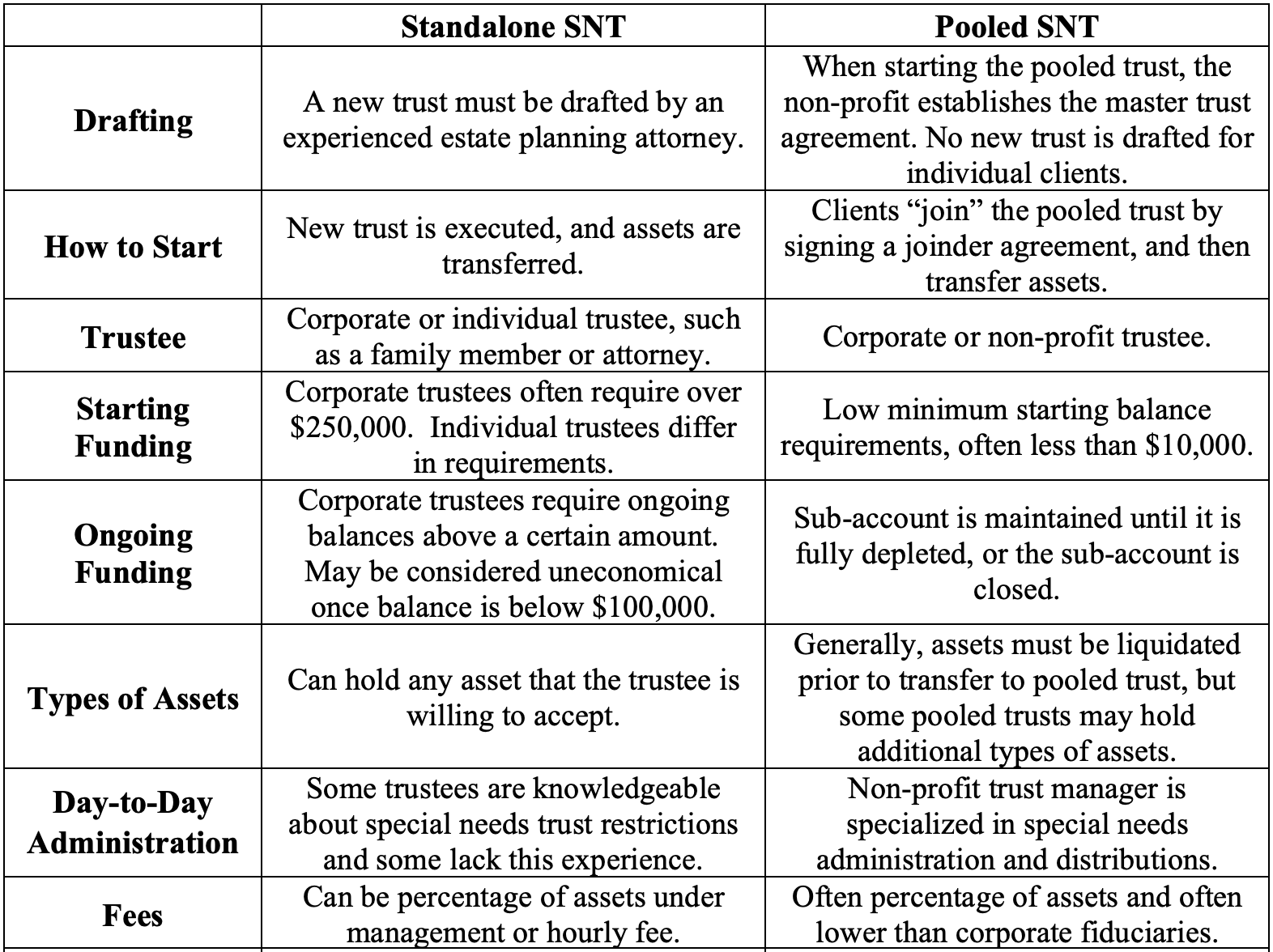

This paper will lay out the basics of pooled special needs trusts, followed by a chart outlining the differences between pooled and standalone special needs trusts and a list of topics to consider when evaluating a pooled special needs trust.

Getting Started

One of the best features of a pooled SNT is that no drafting is needed! When the pooled SNT is established by a non-profit organization, first-party and third-party master trust agreements are drafted by an experienced special needs attorney. A client joins the pooled SNT by completing and signing a first-party or third-party joinder agreement, and then that client then has a “sub-account” with the pooled trust that is governed by the master trust.

Once the client has a sub-account (either first-party or third-party), then the sub-account is ready to be funded. Many pooled trusts have low starting balance requirements—often under $10,000, which makes a pooled SNT a great option for sums under $100,000 that already fall below the standard as an uneconomical trust. First-party sub-accounts are funded with money that belongs to or is owed to the beneficiary, like personal injury settlement proceeds, inheritance left outright to the beneficiary, Social Security back payments, child support, and more. Third-party sub-accounts are funded by estate plans and gifts from the beneficiary’s family and loved ones.

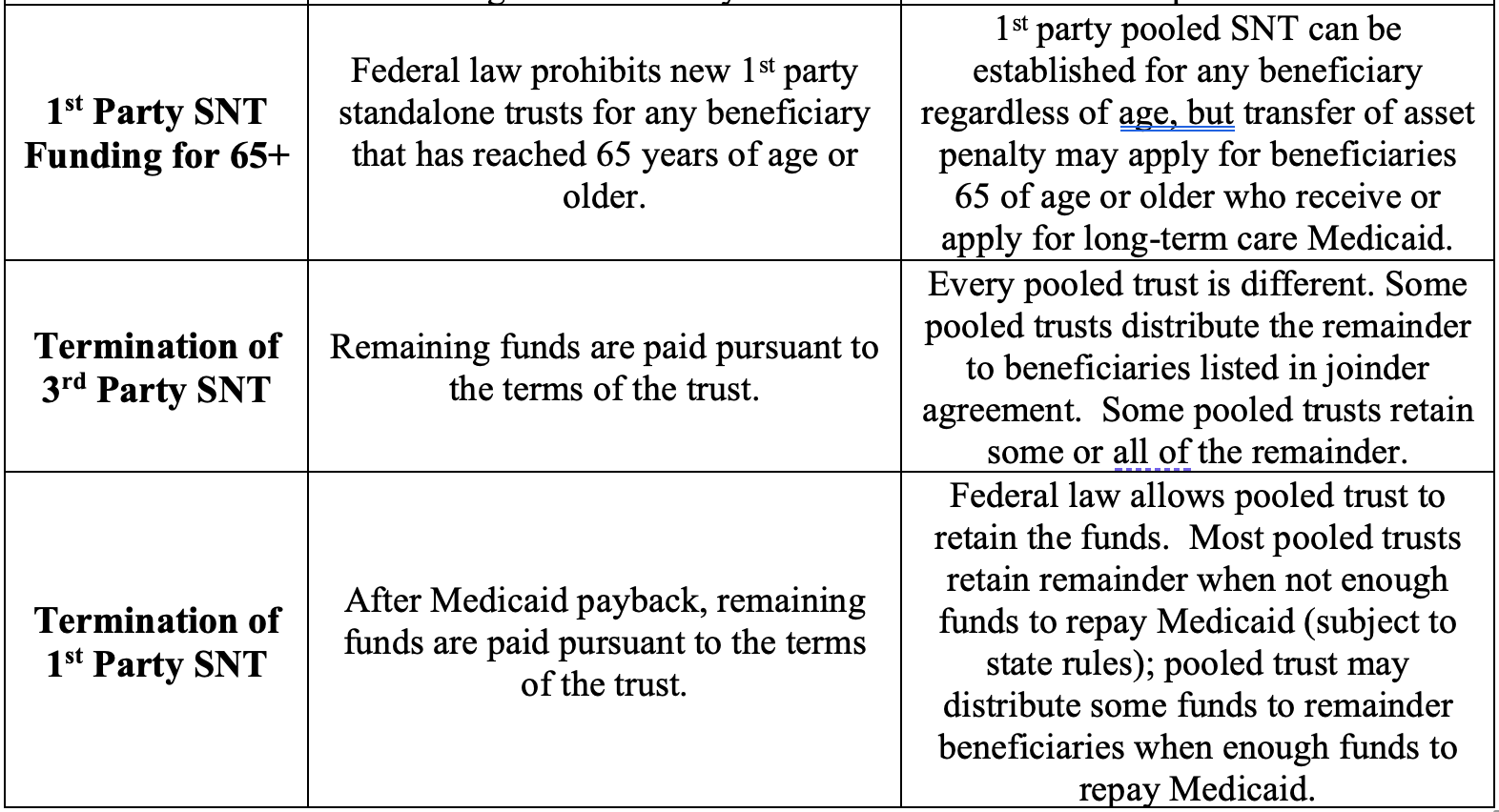

While anyone other than the beneficiary can establish a third-party sub-account for the beneficiary, federal law states that a first-party sub-account may only be set up by the beneficiary; the beneficiary’s agent under a valid power of attorney, legal guardian, parent, or grandparent; or a court.[1] Further, if the beneficiary is sixty-five years of age or older, federal law only allows them to set up a first-party pooled SNT; a standalone first-party SNT is not an option once the beneficiary reaches age 65.[2]

Investments

The pooled SNT is named for its investment structure. While funds in sub-accounts are segregated for ownership and accounting purposes, they are pooled together to invest. This allows for the possibility that the funds will receive a greater return because rather than investing a small sum, the total value of the sub-accounts are pooled together. It is important that the financial advisor, who is advising the trustee, tailor the investment strategy to be appropriate for special needs trust beneficiaries. Pooled trusts will often have more than one portfolio so that beneficiaries can be assigned to a pool with an investment strategy that best aligns with their needs.

Administering the Sub-Account

Once the sub-account is funded, then it can be used for the beneficiary. The normal SNT distribution rules, such as restrictions if the beneficiary receives SSI, apply equally to a pooled and standalone SNT. The beneficiary and their legal representatives, friends, and family work with the pooled trust staff to submit requests for funding and distributions that will enrich the beneficiary’s quality of life. Pooled trusts often have policies regarding what distributions can be approved or denied by a client services staff member and when it should be considered by a distribution committee. Pooled trusts can then directly pay a bill, reimburse a third-party who paid a bill, or load funds onto a pre-paid debit card so that the beneficiary or their representative can make the purchase directly. The pooled trust should also make it easy for the beneficiary to access their sub-account’s balance and see transactions through an online portal or app.

It is also critical that the beneficiary’s funeral expenses be paid in advance using a pre-need contract. Most pooled trusts close the sub-account upon the beneficiary’s passing and are therefore unable to distribute funds to pay for costs related to cremation, burial, funeral, etc.

Closing the Sub-Account

Every pooled trust has a different policy on how it handles remainder funds after the beneficiary passes away. What happens depends on (1) whether the beneficiary had a first-party or third-party sub-account and (2) the rules of the pooled trust.

For third-party sub-accounts, the remainder will be distributed to the remainder beneficiaries named in the joinder agreement, unless it is the policy of the pooled trust to retain part or all of the remaining funds.

For first-party sub-accounts, federal law allows the pooled trust to retain the remaining funds upon the beneficiary’s passing.[3] Even if the pooled trust does not retain the funds, the remainder beneficiaries cannot receive any funds until Medicaid has been fully repaid. Each pooled trust has a different policy on whether they retain funds and when funds can be distributed to remainder beneficiaries after Medicaid has been repaid.

[1] 42 U.S.C. § 1396p(d)(4)(C)(iii); Social Security Program Operations Manual System (POMS) SI 01120.203(D)(6).

[2] 42 U.S.C. § 1396p(d)(4)(A).

[3] 42 U.S.C. § 1396p(d)(4)(C)(iv).

Evaluating a Pooled Special Needs Trust

1. Review the terms of the Joinder Agreement

2. Review the terms of the Master Trust Agreement

3. What are the fees (both enrollment and ongoing)?

4. What is the minimum opening balance?

5. How long has the non-profit served as a pooled trust administrator?

6. Does the non-profit have managerial control over disbursements and day-to-day administration?

7. Who is on the Board of Directors?

8. How many staff members does the non-profit employ and what are their credentials?

9. How many beneficiaries does the organization serve?

10. Can the beneficiary maintain their sub-account if they move to another state?

11. Can the sub-account be transferred to another pooled or standalone special needs trust?

12. Are the governing documents, as well as policies and procedures, easily available on the website?

13. Can clients use an online portal or app to access account information and transactions?

14. Does each client have an assigned client services staff member?

15. Are phones answered during business hours?

16. Can clients easily submit disbursement requests online?

17. What is the timeline for reviewing disbursement requests?

18. Is there a disbursement manual or guide?

19. Can the beneficiary use a pre-loaded debit card to make allowable purchases?

20. What is the remainder policy after the beneficiary passes away?

Presented to the State Bar of Georgia as Continuing Legal Education (CLE).