Investment Information

CCT’s Board of Directors selected True Link Financial to manage and invest the trust funds. True Link was selected because of their expertise and commitment to working with pooled trusts nationally.

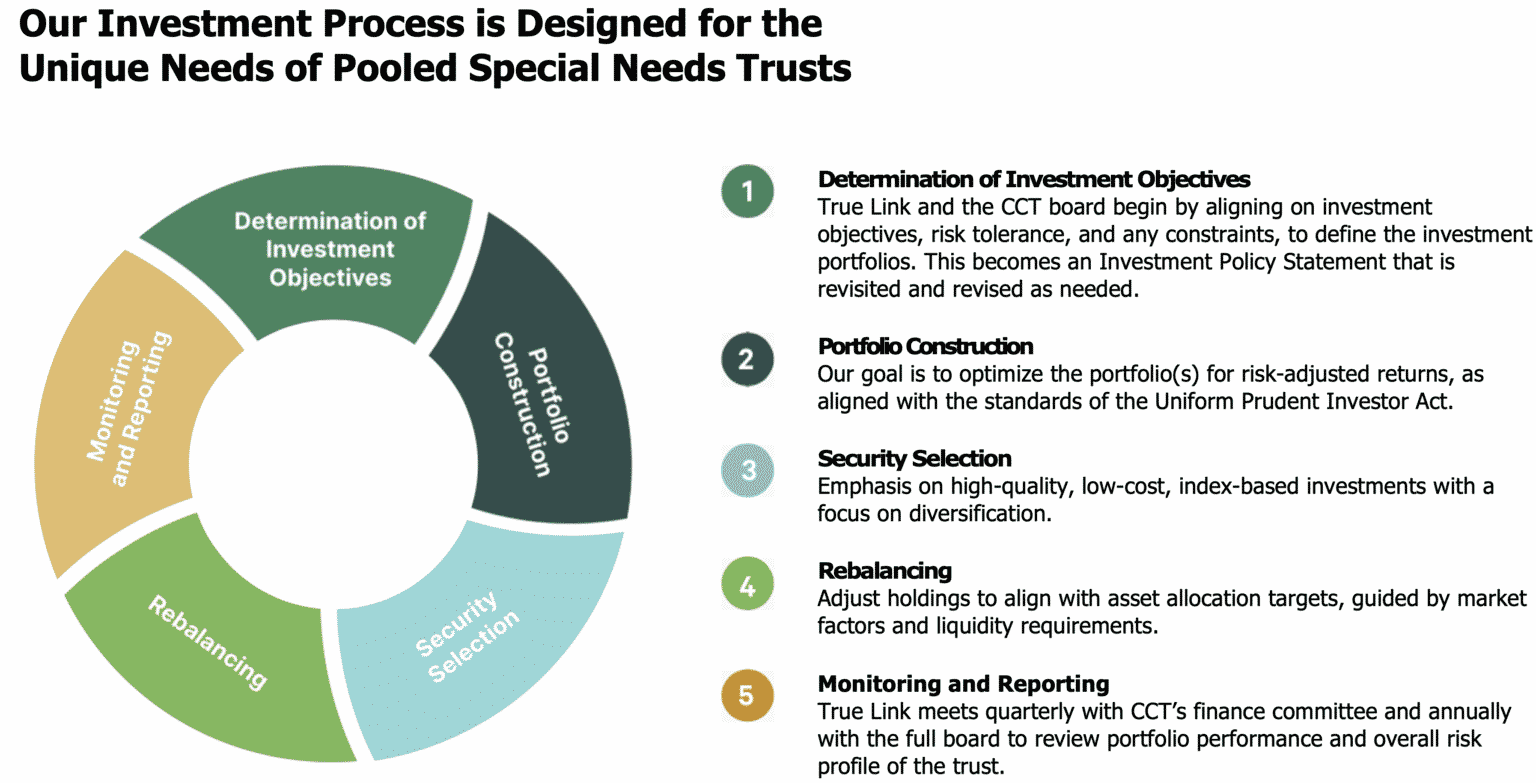

The Board of Directors approves the Investment Policy Statements (IPS) implemented by True Link Financial Advisors and meets quarterly with the True Link Financial Advisors Investment team to review investment performance. Each year, True Link presents the investment performance to the full Board of Directors.

CCT is not a chartered bank or trust company, or depository institution. It is not authorized to accept deposits or trust accounts and is not licensed or regulated by any state or federal banking authority

Management & Investment of

Trust Assets

Pictured: Joanne Marcus, CCT’s President/CEO, Kai Stinchcombe, Co-founder and CEO, and Bryan Kreitzburg, Portfolio Manager at True Link Financial

The funds of the pooled trusts are invested and managed by True Link Financial Advisors, LLC* (True Link).

Each beneficiary has a sub-account which reflects the individual account activity. Cash from all sub-accounts are grouped, or “pooled” together, and invested. The goal of pooling of funds is to reduce the impact of administrative fees and to create the opportunity to invest in a broader range of investment options for the pooled trust. Appreciation and depreciation of invested assets, along with earned income are applied to each sub-account based on the beneficiary’s portion of the total pooled assets. CCT allows only cash deposits into the trust (via check, ACH, or wire); real estate or other non-cash assets are not accepted.

Financial records are maintained for each sub-account that reflect activity in the sub-account, such as sub-account balances, disbursements, and deposits.

The Beneficiary’s advocate named in the Joinder Agreement can access account information online through the Client Account Portal. For additional information about how to read your statement, click here: “How to Read Your Trust Statement.”

Investment Policy Statements

The Investment Policy Statements (IPSs) are carefully crafted and reviewed regularly by the CCT Board of Director’s Finance and Investment Committee. The Committee meets quarterly, or more frequently when needed, with representatives from True Link and Capital First to monitor and review performance of the portfolios. Annually, True Link provides a full report to CCT’s Board of Directors. The IPSs are available below.

First-Party Pooled Special Needs Trust

Third-Party Pooled Special Needs Trust

Settlement Preservation Pooled Trust

True Link

True Link Financial Advisors, LLC[1] serves as the investment manager for the Trusts. Oversight of True Link Financial Advisors is provided by the CCT Board of Directors.

True Link Financial, Inc. provides the trust administration software and record-keeping platform to the Trusts as well as the True Link Visa Prepaid Cards which help manage spending for beneficiaries. The record-keeping platform enables beneficiaries to request disbursements and aids in the provision of their quarterly sub-account statements.

-

About True Link

- Founded in 2012, True Link Financial, Inc. provides financial solutions for those who care for people with complex needs.

- True Link Financial Advisors, LLC (“True Link”) is a wholly owned subsidiary of True Link Financial, Inc. that provides investment management services. True Link Financial Advisors specializes in providing investment services to over 20 pooled special needs trusts that support more than 15,000 beneficiaries.

- Many of the nation’s leading nonprofit trustees, including Commonwealth Community Trust, rely on True Link Financial Advisors to steward their trust assets.

- We do this with a team that has nationally recognized expertise in special needs trusts and investment professionals who bring decades of experience from leading financial institutions across the country. Learn more at truelinkfinancial.com/investments.

-

Footnote [1]

- [1] Investment Management Services are provided through True Link Financial Advisors, LLC, (the “Advisor”) an investment advisor registered with the U.S. Securities and Exchange Commission (“SEC”) and wholly-owned subsidiary of True Link Financial, Inc. (“True Link Financial” and, together with the Advisor, “True Link”) Registration with the SEC authorities as a Registered Investment Advisor does not imply a certain level of skill or training, nor does it constitute an endorsement of the advisory firm by the SEC. The Advisor only provides investment management services upon entering into an Investment Advisory Agreement (IAA) with a client. With respect to pooled trust clients, upon entering into an IAA, the client is the trust; beneficiaries of the trust are not investment advisory clients of the Advisor. Nothing contained herein is an offer or solicitation to buy or sell securities. Non-deposit investment products and trust services offered by True Link Financial Advisors are not insured or guaranteed by the FDIC or any other government agency, are not obligations of any bank, and are subject to risk, including loss of principal.

CCT’s Multiple Portfolio Investment Model

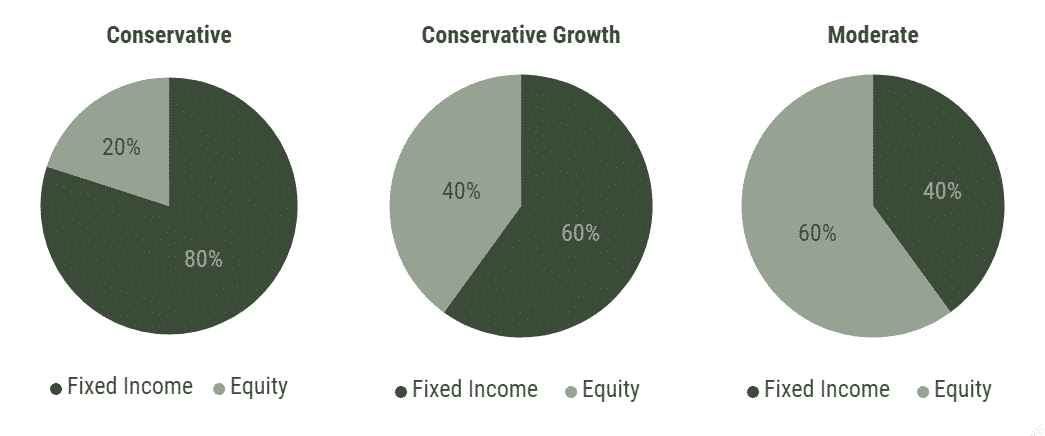

CCT trust assets are invested in one of three portfolios: Conservative, Conservative Growth, and Moderate. Sub-accounts with balances less than $3,000 are held in cash.

Capital First Trust Company (Capital First), trustee for CCT, determines the appropriate portfolio to align with an individual beneficiary’s investment profile.

New accounts are initially assigned to the Conservative Growth portfolio. Accounts are then assessed on an annual basis based on the criteria above (determined by the anniversary date of joining CCT) and then assigned to one of the three portfolios by the Trustee based on the assessment.

-

The following information is used to assess the appropriate portfolio:

- Sub-account value

- Age

- Anticipated spending needs

- Past spending history

- Expected future deposits

Management &

Investment of Trust Assets

As of December 31, 2023, CCT administers over $136 million in pooled trust accounts. This graph** shows the value under management from 2012 to December 31, 2023.

**The change in the value of the funds administered by CCT is attributable to factors such as deposit of additional funds, distributions, change in value of the investments, and investment income earned. This graph is not a depiction of investment performance.

The amounts do not include unfunded Third-Party Pooled Special Needs Trusts. Additionally, many existing trusts continue to be funded over the beneficiary’s life through structured settlements, lifetime contributions, etc.

CCT's most recent Form 990 disclosures are available on the IRS website. https://apps.irs.gov/app/eos/

Dan, Brother and Advocate of a CCT Beneficiary

"CCT has been a blessing to our family. CCT has provided a sense of order, organization, trust, and leadership in helping to provide and protect the well-being of my younger sister. I would recommend CCT to anyone, and I already have." — Dan, Brother and Advocate of a CCT Beneficiary

Dustin, CCT Beneficiary

"I have had nothing but exceptional service from this company, they take their time to help with my needs and make sure I have what I need." — Dustin, Beneficiary of CCT

Cathy, CCT Beneficiary

"With the help of CCT I was able to purchase my Dream vehicle. Emily at CCT was/is a HUGE help! It was a very smooth transaction." — Cathy, Beneficiary of CCT

Grandmother of Beneficiary Kobe

"CCT made getting the wheelchair equip van we so much needed for our grandson the easiest purchase ever. Thank you CCT!!!" — Grandmother of Beneficiary Kobe

Rhonda, Mother and Advocate of a CCT Beneficiary

"CCT has been amazing. Very helpful with guiding us through this process." — Rhonda, Mother and Advocate of a CCT Beneficiary

Nancy, Grandmother and Advocate of a CCT Beneficiary

"CCT has been wonderful in serving the financial needs of my grandson. They are always prompt in answering questions and suggesting how we can make something happen for him. He just turned 18 this year and we still plan on using this service." — Nancy, Grandmother and Advocate of a CCT Beneficiary

Dan, Brother and Advocate of a CCT Beneficiary

"CCT has been a blessing to our family. CCT has provided a sense of order, organization, trust, and leadership in helping to provide and protect the well-being of my younger sister. I would recommend CCT to anyone, and I already have." — Dan, Brother and Advocate of a CCT Beneficiary

Dustin, CCT Beneficiary

"I have had nothing but exceptional service from this company, they take their time to help with my needs and make sure I have what I need." — Dustin, Beneficiary of CCT

CCT

Trusts

Professionals

Clients

*Disclaimer Statement: CCT is not a chartered bank or trust company, or depository institution. It is not authorized to accept deposits or trust accounts and is not licensed or regulated by any state or federal banking authority.

All Rights Reserved | Commonwealth Community Trust